热门资讯> 正文

71 10%+5月份股息收益率最高的狗

2019-05-16 09:32

- Banco Bilbao Vizcaya Argentaria, S.A. Sponsored ADR(BBVA) 0

- Orchid Island Capital, Inc.(ORC) 0

- 马丁油气(MMLP) 0

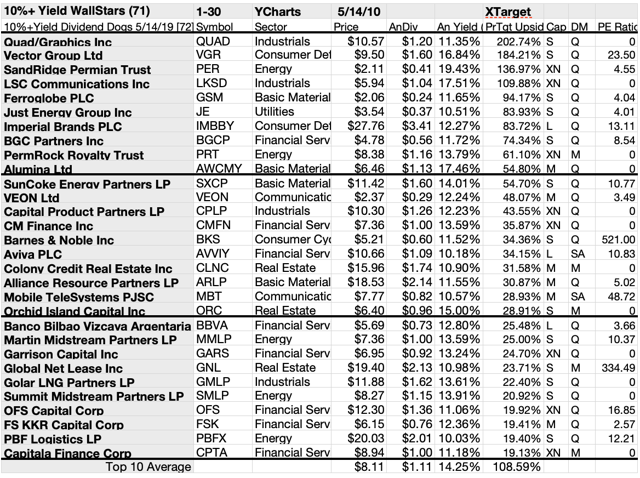

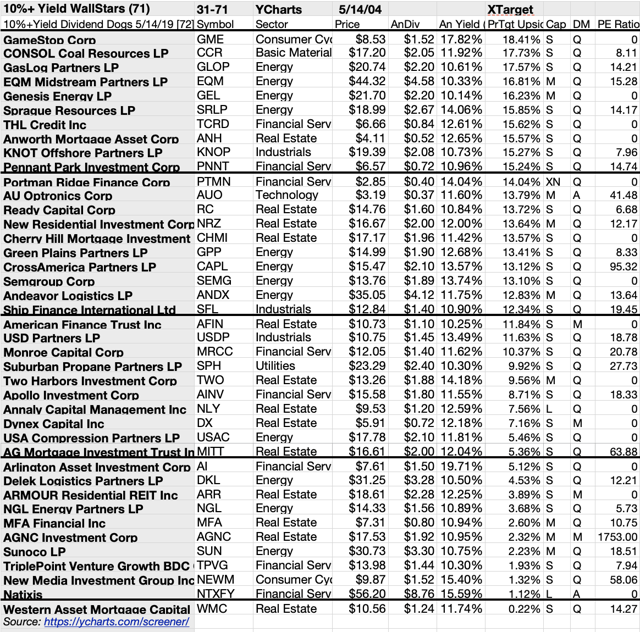

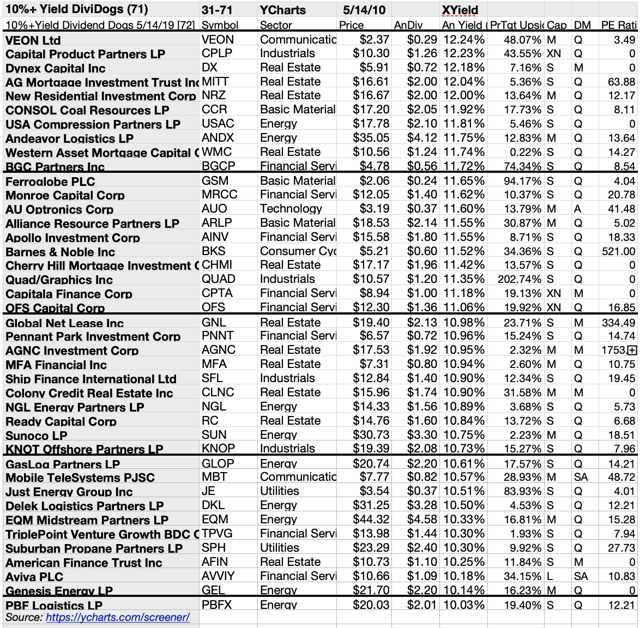

These Top Dogs all show positive broker target price upsides. 71 stocks displayed 10%+ forward yield, $2.00+ prices, and $100M+ market caps 5/14/19. Yields above 12.25% winnowed the list to T.

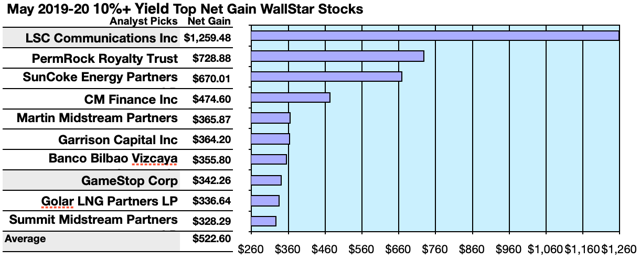

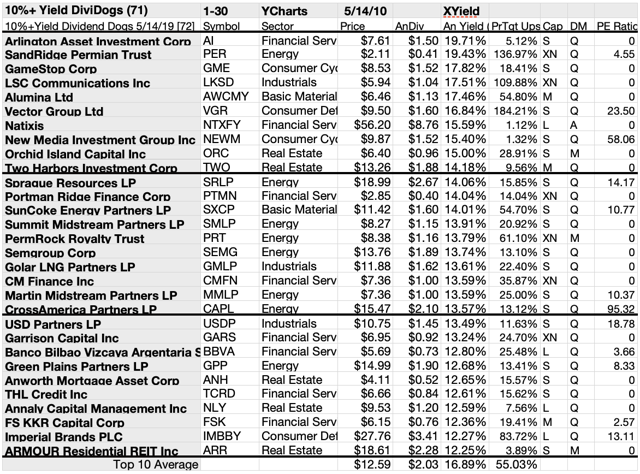

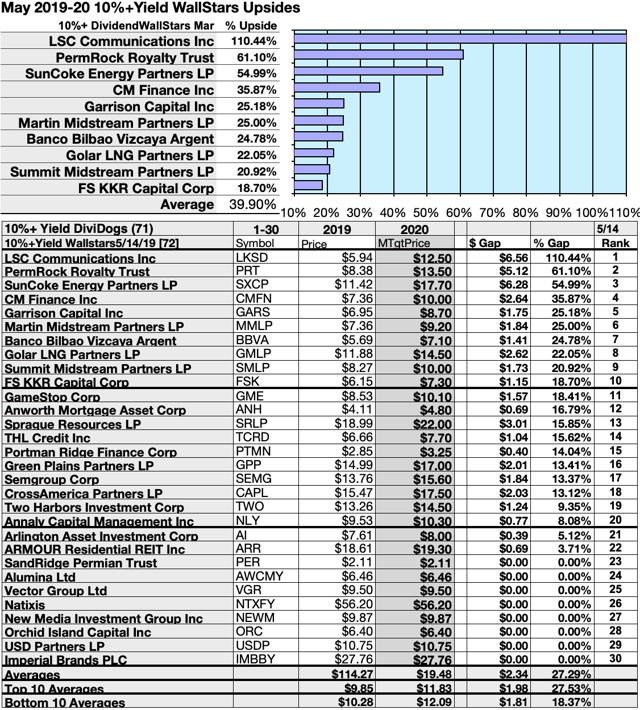

Top dog target-estimated April top-ten net-gain estimates ranged 32.83-125.95% for SMLP, GMLP, GME, BBVA, GARS, MMLP; CM; SXCP, PRT, and top pick, LKSD, per YCharts dividend data.

30 Top stocks estimated annual yield ranged 12.25-19.71%. Top ten, TWO, ORC, NEWM, NXTFY, VGR, AWCMY; LKSDE, GME, PER, and top pick, AI, averaged 16.89% yield.

Top-ten firms by Wall Street target-price upsides FSK, SMLP, GMLP, BBVA, MMLP, GARS, CMFN, SXCP, PRT, and top dog, LKSD averaged a 39.9% estimated price gain.

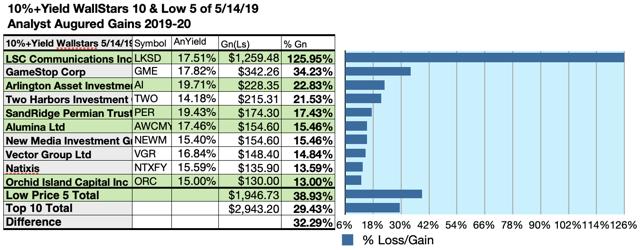

$5k invested 5/14/19 in the lowest-priced five 10%+ top-yield ten dividend stocks showed 32.3% more projected net-gain than from $5k in all ten, per Broker targets. The low-price smaller Top Dogs dominated the May 10%+yield pack.

Two of ten top 10%+Yield WallStars were among the top ten gainers for the coming year (based on analyst 1-year targets). So, this forecast for 10%+ Yields, as graded by Wall St. Brokers, was 40% accurate.

Projections based on dividends from $1000 invested in the highest yielding stocks and aggregate one-year analyst median target prices of those stocks, as reported by YCharts, created the 2020 data points. Note: one-year target prices from single analysts were not applied (n/a). Ten probable profit-generating trades to May 14, 2020, were:

LSC Communications Inc. (

LKSD

) netted $1,259.48 based on the median of target price estimates from three analysts, plus dividends less broker fees. A Beta number was not available for LKSD.

PermRock Royalty Trust (

PRT

) was projected to net $728.88, based on the median of target price estimates from four analysts, plus the estimated annual dividend, less broker fees. A Beta number was not available for PRT.

SunCoke Energy Partners (

SXCP

) was projected to net $670.01, based on target price estimates from three analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to volatility 57% over the market as a whole.

CM Finance Inc. (

CM

) was projected to net $474.60 based on dividends, plus the median of target estimates from two brokers, less broker fees. The Beta number showed this estimate subject to volatility 42% over the market as a whole.

Martin Midstream Partners LP (

MMLP

) was projected to net $365.87 based the median of target price estimates from five analysts, plus the estimated dividends, less broker fees. The Beta number showed this estimate subject to volatility 8% over the market as a whole.

Garrison Capital Inc. (GAR) was projected to net $364.20, based on dividends, plus the median of target price estimates from five analysts, less broker fees. The Beta number showed this estimate subject to volatility 34% less than the market as a whole.

Banco Bilbao Vizcaya Argentaria SA (

BBVA

) was projected to net $355.80, based on a median target price estimate from two analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to volatility 1% less than the market as a whole.

GameStop Corp. (

GME

) was projected to net $342.26, based on a median target price estimate from ten analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to volatility 42% less than the market as a whole.

Golar LNG Partners LP (

GMLP

) was projected to net $416.98 based the median of target price estimates from thirteen analysts, plus the estimated dividends, less broker fees. The Beta number showed this estimate subject to volatility 14% over the market as a whole.

Summit Midstream Partners LP (

SMLP

) was projected to net $328.29, based on dividends plus the median of target price estimates from nine analysts, less broker fees. The Beta number showed this estimate subject to volatility 71% over the market as a whole.

The average net gain in dividend and price was estimated at 52.26% on $10k invested as $1k in each of these ten stocks. This gain estimate was subject to average volatility 11% less than the market as a whole.

Stocks earned the "dog" moniker by exhibiting three traits: (1) paying reliable, repeating dividends, (2) their prices fell to where (3) yield (dividend/price) grew higher than their peers. Thus, the highest yielding stocks in any collection became known as "dogs." More precisely, these are, in fact, best called, "underdogs."

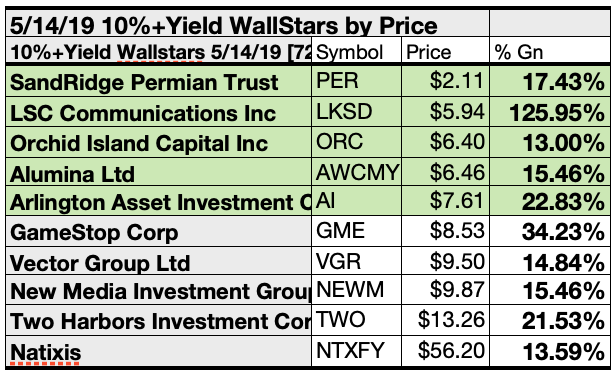

Top ten 10%+Yield Top Dogs selected 5/14/19 by yield represented seven of eleven Morningstar sectors.

Top stock on the list was the first of two

financial

services representatives, Arlington Asset Investment Corp. (NYSE:

AI

) [1], the other financial services dog placed seventh, Natixis (

OTCPK:NTXFY

) [7].

One

energy

stock placed second, SandRidge Permian Trust (

PER

) [2]. Two

consumer cyclical

representatives followed in third and eighth places, GameStop Corp. [3], and New Media Investment Group Inc. (

NEWM

) [8].

One representative in

industrials

placed fourth, LSC Communications Inc. [4]. A single

basic materials

member placed fifth, Alumina Ltd. (

OTCQB:AWCMY

) [5], which was followed by the lone

consumer defensive

sector representative in sixth, Vector Group Ltd. (

VGR

) [6]

Finally, two in

real estate

placed ninth and tenth, Orchid Island Capital Inc. (

ORC

) [9], and Two Harbors Investment Corp. (

TWO

) [10], to complete the 10%+ Yield Top Dog top ten for May 2019-20.

To quantify top yield rankings, analyst mean price target estimates provided a "market sentiment" gauge of upside potential. Added to the simple high-yield metrics, analyst mean price target estimates became another tool to dig out bargains.

Ten top 10%+ Yield Top Dogs were culled by yield for this May update. Yield (dividend/price) results verified by Yahoo Finance did the ranking.

As noted above, top ten 10%+Yield Top Dogs selected 5/14/19 showing the highest dividend yields represented seven of eleven sectors in the Morningstar scheme.

$5000 invested as $1k in each of the five lowest-priced stocks in the top ten 10%+ Yield Top Dogs collection was expected by analyst 1-year targets to deliver 32.29% less net gain than $5,000 invested as $.5k in all ten. The second lowest priced 10%+ top yield WallStar, LSC Communications Inc., was projected by analysts to deliver the best net gain of 125.95%.

The five lowest-priced top 10%+ Yield stocks as of May 14 were: SandRidge Permian Trust; LSC Communications Inc.; Orchid Island Capital Inc.; Alumina Ltd; Arlington Asset Investment Co. (

AI

), with prices ranging from $2.11 to $7.61.

Five higher-priced 10%+ Dividend Top Dogs from April 18 were GameStop Corp., Vector Group Ltd, New Media Investment Group Inc., Two Harbors Investment Corp. and Natixis, whose prices ranged from $8.53 to $7.61.

The distinction between five low-priced dividend dogs and the general field of ten reflected Michael B. O'Higgins' "basic method" for beating the Dow. The scale of projected gains based on analyst targets added a unique element of "market sentiment" gauging upside potential. It provided a here-and-now equivalent of waiting a year to find out what might happen in the market. Caution is advised, since analysts are historically only 20% to 80% accurate on the direction of change and just 0% to 20% accurate on the degree of change.

The net gain/loss estimates above did not factor in any foreign or domestic tax problems resulting from distributions. Consult your tax advisor regarding the source and consequences of "dividends" from any investment.

Stocks listed above were suggested only as possible reference points for your 10%+ Yield WallStar purchase or sale research process. These were not recommendations.

www.indexarb.com

; YCharts.com; finance.yahoo.com; analyst mean target price by Thomson/First Call in YahooFinance. Dog photo:

I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

推荐文章

美股机会日报 | 止跌企稳!纳指期货盘前涨约0.5%,有分析称美股连遭重挫后或回升;亚马逊盘前大跌超8%

一周财经日历 | 事关降息!美国1月非农、CPI数据下周公布;恒指季检结果下周五揭晓

华尔街大多头漫谈黄金“黑天鹅”风险:马斯克实现太空采金,化身全球央行行长

避险情绪席卷市场 华尔街青睐的热门交易纷纷崩跌

华盛早报 | 无一幸免!美股、金银、加密货币与原油集体崩盘;南向资金爆买250亿港元!创约半年来新高;千问APP今日启动30亿免单

亚马逊股价盘后大跌近10%,巨额资本支出引发担忧

比特币暴跌带来124亿美元巨亏 Saylor的金融实验岌岌可危

2月6日外盘头条:比特币暴跌 亚马逊预计今年资本支出将达2000亿美元 交易员料美联储将比预期更早降息