熱門資訊> 正文

加州的转变对穆尼市场意味着什么

2019-05-08 19:54

The turnaround in California has resulted in higher credit quality for many issuers in the state and lower spreads for California muni bonds.

California investors who aren\'t in the highest tax brackets should do some research before adding to positions, as it may be possible to achieve higher after-tax yields with out-of-state-munis.

Even though spreads are very tight, California investors in the state\'s top tax brackets may still achieve higher after-tax yields by sticking with in-state munis.

California's finances were a mess following the 2008 credit crisis, but that's no longer the case. The turnaround in the Golden State has resulted in higher credit quality for many issuers in the state and lower spreads for California muni bonds.

As a result, California investors who aren't in the highest tax brackets should do some research before adding to positions, as it may be possible to achieve higher after-tax yields with out-of-state-munis. However, California investors in the state's top tax brackets may still achieve higher after-tax yields by sticking with in-state munis.

Following the 2008 credit crisis, the state's general obligation (GO) bonds were the lowest-rated of any state. Politically, California required a two-thirds majority to pass a budget, leading to cash flow challenges; the rainy-day fund was depleted; and real estate construction and values in many areas experienced a dramatic bubble, then collapsed. Spreads

for a broad index of California muni bonds were higher than those of other financially stressed states like New Jersey, Connecticut and Illinois. At one point, spreads were close to those of bonds issued by Puerto Rico, which is now going through a major debt restructuring.

The situation has since improved. The last two governors, primarily Jerry Brown, successfully pushed through resolutions to reduce the votes needed to pass a budget and manage cash flows to a simple majority, and increased the rainy-day fund. Meanwhile, the economy has improved.

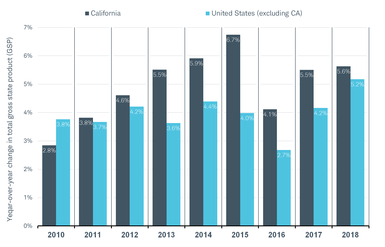

With 12% of the U.S. population, a very diverse economy, and a growing population, California has benefited from the national economic recovery, but at an ever faster pace. The year-over-year change in the state's economic output has surpassed that of the nation since 2010, according to the Bureau of Economic Analysis. The state also has taken measures to pay down debts incurred during the 2008 credit crisis and to contribute to its rainy-day fund. As a result, the state has steadily increased the amount of "unused borrowable resources" since 2019, which is now near 25% of total-year spending, according to credit rating agency Moody's Investors Service.

California's economic output has been stronger than the country's

(Source: Bureau of Economic Analysis, as of 05/01/2019)

Non-economic factors also have contributed to the state's financial recovery. In 2010, California voters approved a measure that lowered the threshold for passing a budget from a two-thirds majority in the legislature to a simple majority. Previously, the state's budget had been signed on time in only four out of 22 years. Since the measure was enacted, the state has had "eight years of strong budget management" that has helped to "dramatically strengthen" the state's budget position, according to Standard & Poor's (S&P).

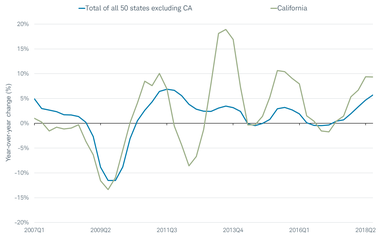

Relative to other states, California has a high reliance on capital gains taxes and its top income earners. In fact, the top 1% of earners accounted for 46% of the state's personal income taxes for tax year 2016, according to Moody's. To help combat this, then Gov. Jerry Brown put through measures in 2014 to contribute to a rainy-day fund. The fund is expected to continue to grow, based on current Gov. Gavin Newsom's proposed budget. The fiscal discipline exhibited by the Brown administration helped contribute to the state's financial recovery, in our view.

California's revenues are more volatile than those of other states

(Source: The Pew Charitable Trusts, data as of Q3 2018 and last updated as of 4/23/2019. Note: Four-quarter moving average adjusted for inflation (2017 dollars, in thousands) by The Pew Charitable Trusts)

Newsom's fiscal 2020 executive budget proposal appears to "largely continue the previous administration's policy of building up reserves and one-time spending flexibility to prepare for the next recession," according to S&P. We think the continuation of fiscal restraint should continue to support the state's credit quality.

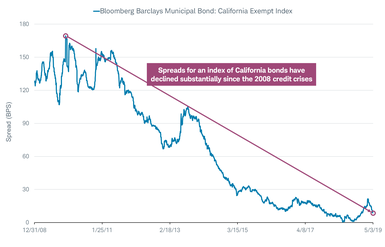

The improvement in the state's finances has, in part, contributed to lower spreads for California bonds. Spreads for a broad index of California bonds have been steadily decreasing since the 2008 credit crisis to the point where yields for an index of California bonds yields are close to that of an AAA-rated index, as shown in the chart below. Because the state is rated lower than AAA - at Aa3 by Moody's and AA- by S&P - investors are taking on lower-rated debt with relatively small pickup in compensation from yield. As a result, we think California investors who aren't in a high in-state tax bracket but are looking to add positions may want to consider bonds from outside California as a complement to their existing holdings. Due to low spreads for bonds issued by California entities, it could be possible to achieve higher after-tax yields with out-of-state munis, even after accounting for the tax differences.

Yields for California bonds are close to yields for an AAA index

(Source: Difference in yield to worst between the Bloomberg Barclays Municipal Bond: California Exempt and Bloomberg Barclays Municipal Bond AAA Index, as of 4/30/2019. Note the difference in yield to worsts may be attributable to other factors such as durations, coupons, maturities, etc.)

Even though spreads are very tight, California investors in the state's top tax brackets may still achieve higher after-tax yields by sticking with in-state munis. In particular, they may want to look to California GO bonds and local school district GO bonds, as we think they will be the most positively affected by the state's economic recovery. Higher revenues will give the state more flexibility to meet its debt service. State GO bonds are supported by a dedicated pledge by the state and are second only to education funding in terms of priority of payments from the state's general fund.

In our opinion, local school district GO bonds should also benefit from their solid tax backing. Local school district bonds are generally secured by an unlimited and dedicated property tax pledge. They generally also have strong oversight. The underlying economics and characteristics of the district's tax bases will vary widely, though. In our opinion, districts with a larger and wealthier tax base will generally have stronger tax bases available to pay debt service.

The turnaround in California's financial position has been one of the most remarkable in the nation, but it may be nearing a peak, according to S&P. There are several issues that could negatively affect the state's finances going forward:

____________

A spread is the additional yield a security offers compared with a highly rated index or security, for example a Treasury bond, to compensate investors for increased risks.

Editor's Note:

The summary bullets for this article were chosen by Seeking Alpha editors.

推薦文章

港股周報 | 中國大模型「春節檔」打響!智譜周漲超138%;鉅虧超230億!美團周內重挫超10%

一周財經日曆 | 港美股迎「春節+總統日」雙假期!萬億零售巨頭沃爾瑪將發財報

一周IPO | 賺錢效應持續火熱!年內24只上市新股「0」破發;「圖模融合第一股」海致科技首日飆漲逾242%

從軟件到房地產,美國多板塊陷入AI恐慌拋售潮

Meta計劃為智能眼鏡添加人臉識別技術

危機四伏,市場卻似乎毫不在意

美股機會日報 | 降息預期升溫!美國1月CPI年率創去年5月來新低;淨利、指引雙超預期!應用材料盤前漲超10%

財報前瞻 | 英偉達Q4財報放榜在即!高盛、瑞銀預計將大超預期,兩大關鍵催化將帶來意外驚喜?