熱門資訊> 正文

最后的避风港:每月免税5%收益率,没有K-1

2019-08-16 21:15

The major indexes fell more than -3% Wednesday, 8/14/19.

This sub-sector was up that day and has beaten the market in all three recent pullbacks.

The nominal tax-free yields are 4.5% - 4.8%, which are equivalent to ~6% to over 7%, and higher, depending upon your tax bracket.

Looking for a safe haven from the latest market turbulence? No worries, you're not alone - after Wednesday's bloodbath, which saw all three major indexes lose more than 3%, we went looking for more pullback fighters - safe havens where an income investor could earn a decent yield.

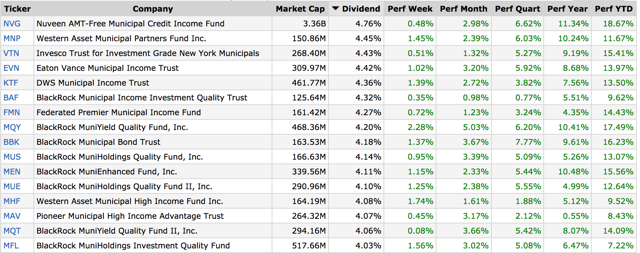

We came across this refreshing "sea of green" - when was the last time you saw that many green, positive performance numbers for the past week, month, quarter, year, and year-to-date? And with 4%-plus dividend yields?

These closed-end funds focus on US-based municipal debt, and, thanks to the reversal of interest rate hikes, they've been enjoying quite a comeback, particularly since the Q4 '18 market pullback, where the S&P 500 lost more than -20%.

Figuring that there had to be a catch somewhere, we went digging further, and found that many of these funds had cut their dividends in 2019, except for these two: Western Asset Municipal Partners Fund (MNP) and Nuveen AMT-Free Municipal Credit Income Fund (NVG).

Figuring that there had to be a catch somewhere, we went digging further, and found that many of these funds had cut their dividends in 2019, except for these two: Western Asset Municipal Partners Fund (MNP) and Nuveen AMT-Free Municipal Credit Income Fund (NVG).

MNP has a much smaller market cap, at ~$150M, vs. $3.36B for NVG. NVG yields 4.76%, while MNP yields 4.45%.

However, there's a useful tax-free attraction for both of them - since they invest in municipal debt, they're tax-free for federal taxes. (We expand on this further, in the Distributions section.)

We dropped these two into our WayBack Machine to see how they both performed during the most recent three pullbacks.

MNP performed the best during the big Q4 '18 pullback, actually gaining 5.2% vs. a -6.77% decline for NVG. Still, though, both handily outperformed all three of these major indexes and also paid out monthly dividends on top of that.

More recently, MNP also outperformed during the May 2019 pullback, gaining 2.56%, vs. 1.81% for NVG, while the S&P lost -5.83%, the Dow lost -6.11%, and the Nasdaq lost -7.41%.

However, during our current pullback, from the July 2019 highs, NVG has outperformed, rising 2.91%, vs. 1.91% for MNP, and -5.74% for the S&P.

MNP actually rose on Wednesday, 8/14/19, up .32%, while NVG was nearly flat, at -.18%, vs. -3.08% for the S&P:

Here's a look at other time periods going back to one year, which shows both MNP and NVG outperforming the S&P 500 over the past week, month, quarter, and year.

NVG also outperformed during 2019, gaining 18.67%, vs. 13.8% for the S&P, whereas MNP gained 11.67%. However, if you were to add in the monthly distributions for MNP, it would be slightly higher than the S&P year to date, on a total return basis.

Profiles:

MNP - Western Asset Municipal Partners Fund Inc. is a closed ended fixed income mutual fund launched and managed by Legg Mason Partners Fund Advisor, LLC. The fund is co-managed by Western Asset Management Company. It invests in fixed income markets of the United States. The fund primarily invests in investment grade tax exempt securities issued by municipalities.

NVG - Nuveen AMT-Free Municipal Credit Income Fund is a closed ended fixed income mutual fund launched by Nuveen Investments, Inc. The fund is co-managed by Nuveen Fund Advisors LLC and Nuveen Asset Management, LLC. It invests in the fixed income markets of the United States. The fund invests in undervalued municipal securities and other related investments exempt from regular federal income taxes that are rated Baa/BBB or better by S&P, Moody's, or Fitch, and that have an average maturity of 17.02 years.

Both funds use leverage of over 30% to ramp up their yields. MNP's total expenses of 1.42%, are lower than NVG's, at 2.39%, and it also has a positive undistributed net investment income figure, UNII, of $.1157, vs. -$.034 for NVG.

Another major difference between the two funds is that MNP's average daily volume is only 24K, vs. 289K for NVG:

Distributions:

Both funds pay monthly, with MNP yielding 4.45%, and NVG yielding 4.75%. NVG has much better five-year distribution growth, of 3.43%, vs. -3.04% for MNP, which trimmed its monthly payout in May 2018 from $.0625 to $.0575, in addition to trimming it in 2016-2017.

The yields are 4.45% for MNP, and 4.76% for NVG,

, both funds' distributions aren't subject to federal US taxes.

MNP's tax-free 4.45% yield is equivalent to 5.69% for an investor in the 22% tax bracket. The tax benefit rises along with your tax bracket - the equivalent yield is 5.84% if you're in the 24% tax bracket, and 6.92% if you're in the 6.92% bracket. The top 40.80% bracket would have a taxable equivalent yield of 7.50%.

Similarly, NVG's 4.76% tax-free yield is equivalent to 6.05% for those in the 22% tax bracket; 6.21% for the 24% bracket, and 7.35% for the 35.8% bracket:

There was no return of capital for either fund over the past 12 months.

Holdings:

MNP's top municipal sectors were transportation, 20.8%, and industrial revenue, 16.7%, followed by roughly equal weightings in healthcare, water/sewer, and lease-backed debt. The credit quality is primarily investment grade.

New York and California were its largest issuers, at ~20%, respectively, followed by Illinois, at 13%, New Jersey, at 12%, and Texas at~11%, as of 5/31/19.

Source: MNP site

NVG's top 10 sectors were healthcare, 20.35%, tax obligations, ~28%, and transportation, 12.39%, with several other categories in the ~6% to 8.6% range:

As with MNP, NVG's holdings are primarily investment grade:

Pricing:

MNP's current discount to NAV is -8.38%, a bit lower than its one-year average -10.86% discount, whereas NVG has a much smaller discount to NAV of -4.61%, vs. its -8.12% one-year average discount.

Here are the most recent Z-scores for both funds:

All tables furnished by HiddenDividendStocks.com, unless otherwise noted.Disclaimer: This article was written for informational purposes only, and is not intended as personal investment advice. Please practice due diligence before investing in any investment vehicle mentioned in this article.

I am/we are long NVG, MNP.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

推薦文章

美股機會日報 | 止跌企穩!納指期貨盤前漲約0.5%,有分析稱美股連遭重挫后或回升;亞馬遜盤前大跌超8%

一周財經日曆 | 事關降息!美國1月非農、CPI數據下周公佈;恆指季檢結果下周五揭曉

華爾街大多頭漫談黃金「黑天鵝」風險:馬斯克實現太空採金,化身全球央行行長

避險情緒席捲市場 華爾街青睞的熱門交易紛紛崩跌

華盛早報 | 無一倖免!美股、金銀、加密貨幣與原油集體崩盤;南向資金爆買250億港元!創約半年來新高;千問APP今日啟動30億免單

亞馬遜股價盤后大跌近10%,鉅額資本支出引發擔憂

比特幣暴跌帶來124億美元鉅虧 Saylor的金融實驗岌岌可危

2月6日外盤頭條:比特幣暴跌 亞馬遜預計今年資本支出將達2000億美元 交易員料美聯儲將比預期更早降息